Welcome back. This is chapter 11 of the Psychology of Money. This chapter is more a psychological perspective shift, and one that is fundamental to a happier investment journey.

Chapter 11: Reasonable > Rational

One of the quiet mistakes we make with money is assuming that entering finance requires us to become a different kind of human. Calm. Mechanical. Spreadsheet-brained. As if emotions are a bug to be eliminated rather than a constraint to be worked with.

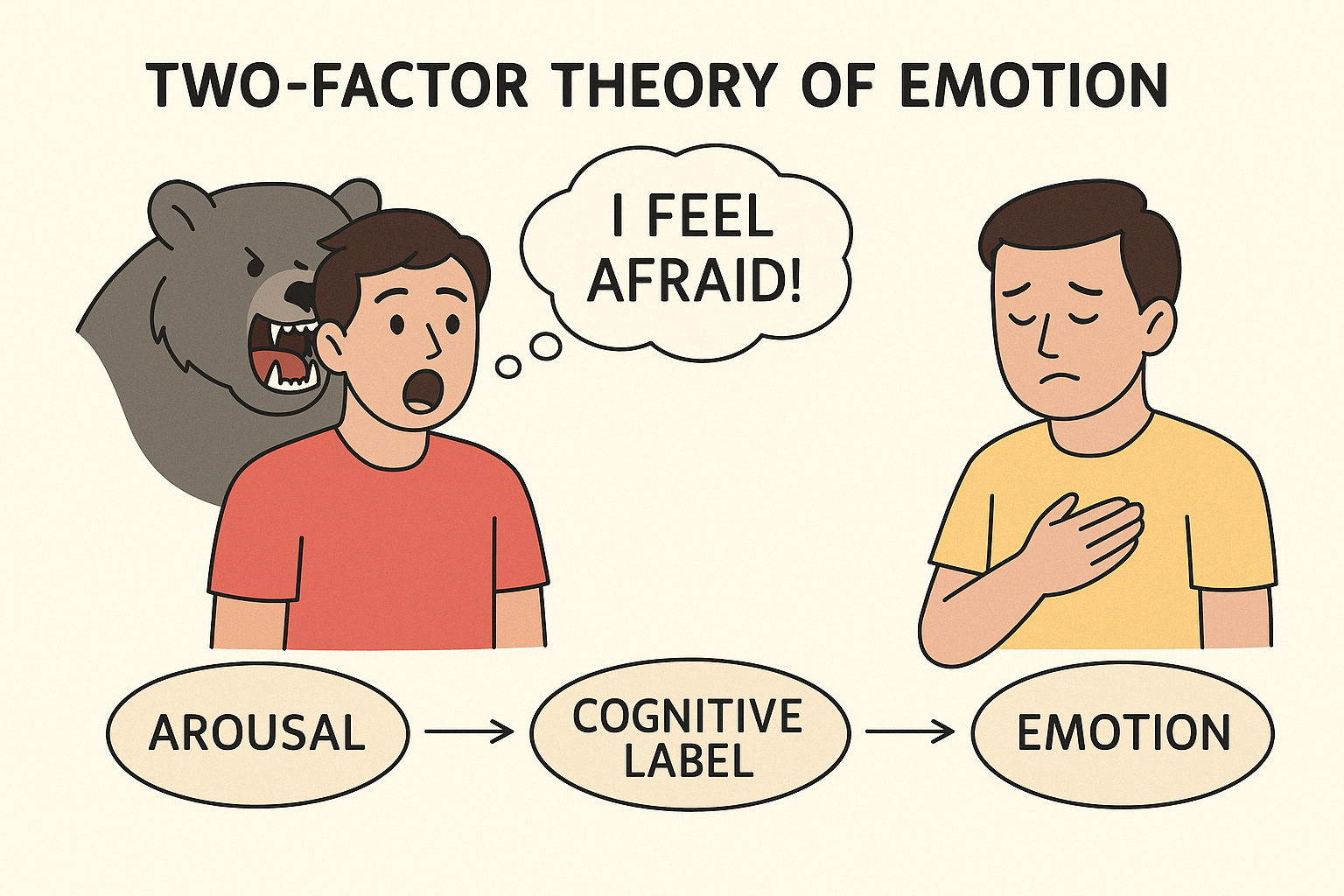

That expectation is misplaced. We are not rational creatures who occasionally feel. We are emotional creatures who occasionally reason. Trying to behave like a perfectly rational agent in finance isn’t admirable—it’s fragile. Reasonable behavior works better, not because it’s softer, but because it’s survivable.

The distinction matters. Rational choices often look optimal on paper, but they ignore the lived experience of the person making them. In medicine, this is well understood. A treatment can be technically correct and still unacceptable if the patient cannot tolerate it. The goal isn’t theoretical perfection; it’s a cure that the human body and mind can actually endure. Finance is no different. A strategy that demands emotional numbness will eventually be abandoned, usually at the worst possible moment.

This is why investing isn’t just mathematical—it’s social and psychological. Money is tied to identity, effort, time, and security. Even people who claim to invest “objectively” still feel attachment, because the money represents work already done and futures imagined. Pretending otherwise doesn’t remove emotion; it just blinds you to when it will surface.

Optimizing for peace of mind is often criticized as settling. That criticism misses the point. Optimizing for sleep doesn’t require mediocrity; it merely reduces the probability of extraordinary outcomes. And that trade-off is reasonable in the long run. Not everyone needs extraordinary outcomes. Above average, held consistently, is sufficient. The mistake is assuming that anything short of exceptional is failure, when in reality it is often the most stable form of success.

The danger zone is thin. Reasonable behavior only works if it is still anchored in rational thinking. Without that anchor, comfort turns into excuse. This is where discipline matters: adjusting a plan when evidence changes, without abandoning it the moment it becomes uncomfortable. The human brain, left unchecked, will always drift toward the easiest relief. That’s not a moral failure—it’s default behavior.

Financial advice fails when it resembles fad diets. The logic is sound. The results look impressive in controlled conditions. But the side effects are ignored, and adherence collapses. Advice that works only when people behave unlike themselves isn’t good advice. It’s theory masquerading as guidance.

A slightly suboptimal plan you can follow beats an optimal plan you constantly second-guess. And a reasonable strategy, revisited and improved over time, quietly outperforms rigid rationality that breaks under stress. Finance rewards those who stay—not those who calculate perfectly and leave early.

In the end, the goal isn’t to outthink the market. It’s to build a system you can live inside without betraying yourself when things get hard.

RELATED POSTS

View all