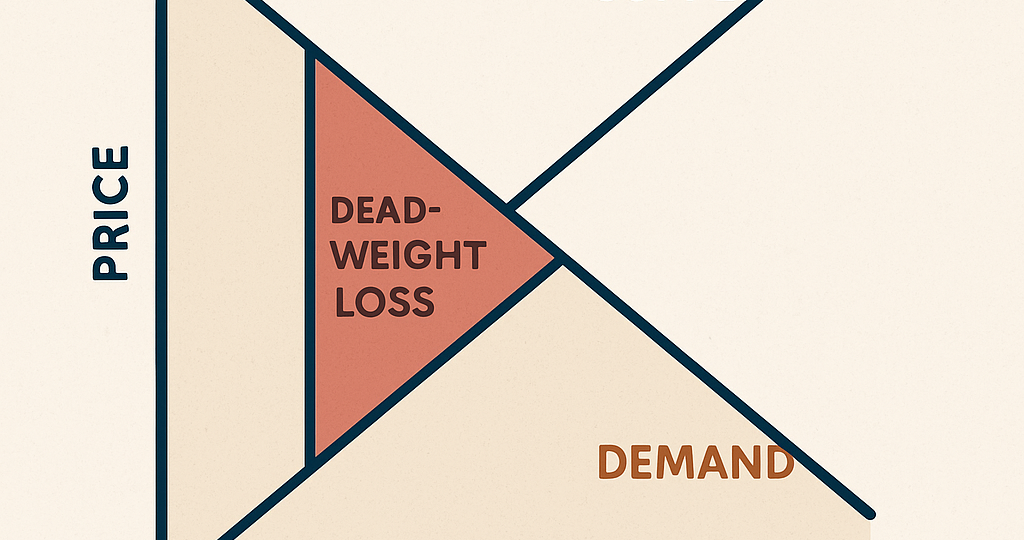

Have you ever paid more for something just because of a tax, or skipped buying it altogether because it became too expensive? That lost transaction—that moment where neither the buyer nor the seller benefits—is what economists call deadweight loss. It’s the invisible cost of market inefficiency, where potential economic value simply vanishes.

Deadweight loss often happens when governments impose taxes, subsidies, or price controls. For example, suppose a new tax raises the price of soda. Consumers buy less of it, and producers sell less. The government collects revenue from the tax, but there are transactions that would have happened—sales that would have benefited both sides—that now don’t. The value from those lost exchanges is gone. Nobody gets it. It’s not transferred—just lost. That’s the “deadweight.”

This concept also applies to monopolies. A monopoly is a single company that handles 100% of the market. So basically, there is only 1 seller. When a single seller controls the market and raises prices above what a competitive market would allow, some consumers can’t or won’t buy the product. Again, transactions that could have created mutual benefit disappear. These missed opportunities shrink overall economic welfare, and that loss is a hidden cost of inefficient market structures.

Understanding deadweight loss helps policymakers evaluate the trade-offs of regulation and taxation. While taxes may be necessary for funding public goods, they must be carefully designed to minimize the unintended side effect of killing off win-win exchanges.

RELATED POSTS

View all