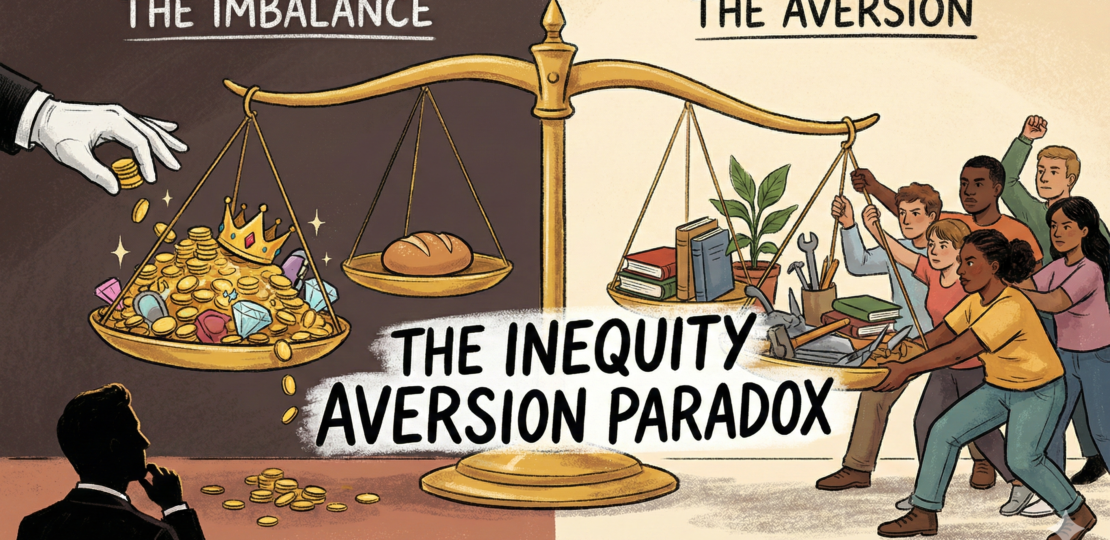

Imagine this: There is $1000 on the table. A stranger offers you $100, but only if you agree that they get $900. Pure logic says you should accept—$100 is better than nothing. Yet many people refuse. Behavioral economics calls this behavior inequity aversion, and it reveals a surprising truth: humans care about fairness even when it costs them.

This shows up clearly in the ultimatum game, a classic experiment. One person proposes how to split a sum of money; the other can accept or reject. If the offer is rejected, both get nothing. Rational self-interest predicts that any positive offer should be accepted. Reality disagrees. Low, “unfair” offers are often rejected out of principle, even though rejection leaves everyone worse off.

From an evolutionary perspective, this makes sense. In small social groups, tolerating unfair treatment could invite exploitation. Punishing unfairness—even at personal cost—signals that you’re not an easy target. What looks irrational in a lab makes long-term sense in a social world where reputation matters.

Modern markets still carry this ancient wiring. Employees react strongly to perceived pay inequity, customers boycott companies seen as exploitative, and people willingly pay more to support “fair” brands. These reactions aren’t bugs in the system; they’re features of a species built for cooperation, not cold calculation.

Behavioral economics doesn’t argue that fairness always leads to optimal outcomes. It argues that humans aren’t machines designed to maximize money. We’re social thinkers, willing to sacrifice a little gain to defend a sense of justice. In that trade-off between profit and principle, a lot of human behavior suddenly makes sense.

RELATED POSTS

View all