Think about this for a second. Imagine a place where self-interest can actually be good for society. Can you think of one? Well, research suggests that’s how most supply and demand works.

Let’s take an example. Imagine you’re at a bustling farmer’s market. You didn’t coordinate with the apple grower, the baker, or the honey vendor—yet somehow, everything you need is there. Prices fluctuate, goods appear or disappear based on what people want, and despite no single person running the show, the entire system runs like a well-oiled machine. This is the magic that 18th-century Scottish economist Adam Smith famously called the “invisible hand.”

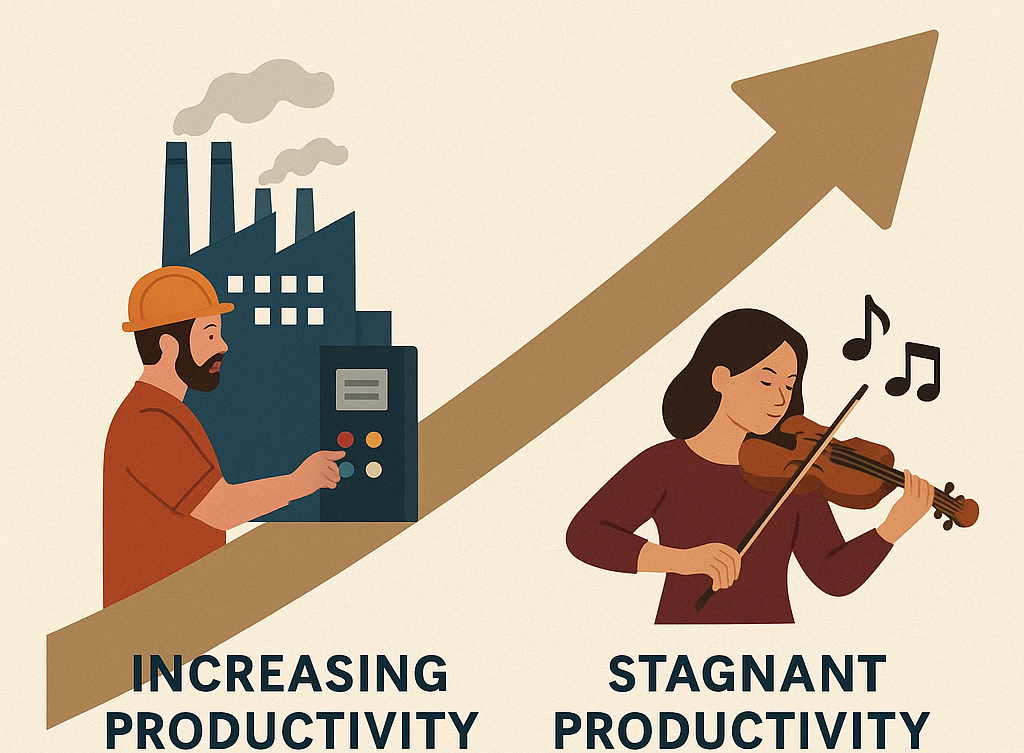

First introduced in his seminal 1776 work The Wealth of Nations, the invisible hand describes the unintended social benefits of individual self-interested actions. Smith argued that when individuals pursue their own gain—whether that’s a baker selling bread or an investor seeking profit—they inadvertently contribute to the economic well-being of society as a whole. Rather than chaos, this decentralized decision-making leads to order. For instance, if bakers notice more people want sourdough, they’ll produce more of it. If a product is too expensive, consumers won’t buy it, and sellers will be forced to lower prices. Without any central planning, supply meets demand in a delicate and responsive dance.

What makes the invisible hand so revolutionary is how it explains the power of free markets. Unlike monarchies or command economies, which relied on rulers to decide what should be produced, market economies allowed millions of individual decisions to organically coordinate production and distribution. Smith wasn’t promoting greed or saying the market is perfect—he believed in morality and regulation—but he was highlighting how people acting out of self-interest could generate efficient outcomes without needing to consciously work for the public good.

Today, the invisible hand still underpins modern capitalism and economic theory. While economists have since debated its limits and added nuance—like the existence of market failures, monopolies, or externalities—the core idea remains foundational: sometimes, the best way to serve others is simply by serving yourself, ethically and productively. The invisible hand may not be seen (it wouldn’t be invisible otherwise), but its influence is everywhere—from your morning coffee to global financial markets.

RELATED POSTS

View all