Welcome back. This is chapter 15 of the Psychology of Money. It’s one liner? Nothing’s free. Let’s dive in.

Chapter 15: Nothing’s Free

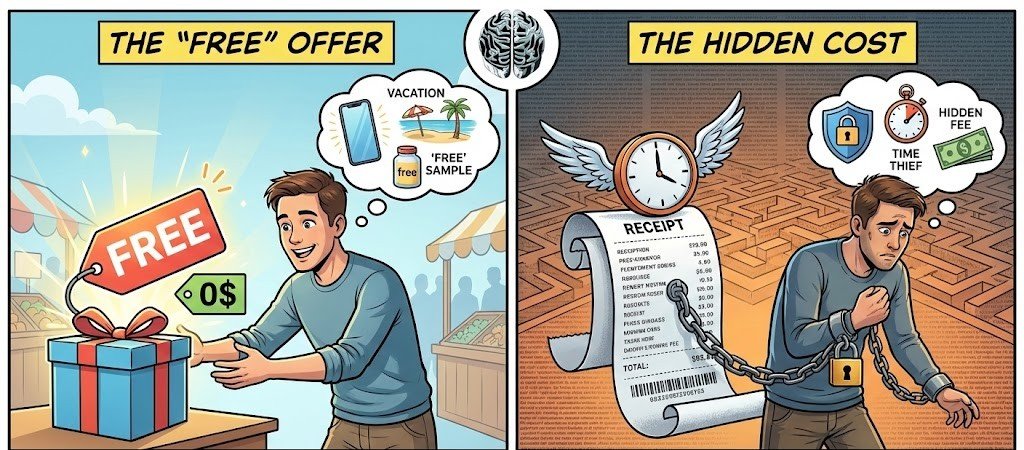

Everything has a price. The mistake is assuming the price is always money. In reality, anything that exchanges comfort, lifestyle, time, or emotional ease for a future outcome is a cost. Sometimes it’s psychological—fear, doubt, regret. Sometimes it’s lifestyle—restraint, missed indulgence, delayed gratification. Sometimes it’s monetary. The form changes, but the rule doesn’t. Nothing is free.

The danger isn’t that people refuse to pay the price. It’s that they misidentify it. Investing advice like “just hold for the long run” sounds simple because the cost isn’t printed on the label. The bill arrives later, during crashes, when confidence evaporates and discipline is tested under stress. The price of long-term returns is volatility, uncertainty, and emotional discomfort—paid repeatedly, not once. This is why many strategies fail not in theory, but in practice.

Most people instinctively try to avoid paying that price. They search for returns without volatility, comfort without sacrifice, certainty without risk. This isn’t malice—it’s human instinct mixed with optimism and self-deception. But history shows that trying to dodge the price often means paying more. Tactical funds, engineered to smooth out discomfort, largely failed to outperform simple portfolios. By avoiding visible pain, investors quietly accepted hidden fragility.

The same pattern appears outside investing. Early financial independence demands restraint in years when spending feels most natural. You trade some freedom in your prime for expanded freedom later. Not everyone wants that trade, and that’s fine—but most people can’t have both. Every path extracts payment; the only choice is when and how.

The most dangerous costs are the ones deferred. Systems that appear stable by borrowing from the future eventually collapse under the weight of their own illusion. General Electric didn’t fail because it took risks—it failed because it manufactured certainty. Short-term stability was purchased by quietly accumulating fragility. When the bill arrived, it arrived all at once.

A healthier mindset is to treat volatility as a fee, not a fine. No one complains about the entry fee to a theme park if the experience delivers value. The same applies to investing. Discomfort is not evidence that something is broken; often, it’s proof that the price is being paid as expected. Of course, there are no guarantees—storms happen even in well-designed systems. But refusing to acknowledge the price never reduces it. It only ensures you’ll be surprised when the bill comes due.

Nothing is free. The earlier you recognize the cost, the more agency you retain in choosing how to pay it.

RELATED POSTS

View all