Welcome. With this post, my biggest project to date comes to an end. It was a complete coincidence, and a fair bit of a counting problem on my part, that this project comes to a close on the 31st of December. It’s quite liberating though, to approach 2026 with new ideas and new projects. Anyway, this is Chapter 20, a chapter on how Housel actually looks at money.

Chapter 20: Confessions

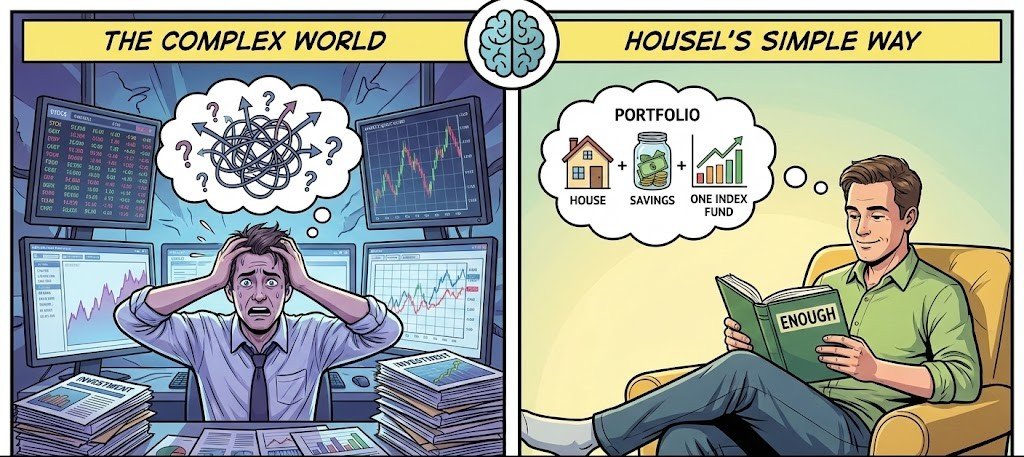

Housel is clear that there is no universal formula for financial success. What matters isn’t optimization in some abstract sense, but whether your choices align with the life you want and allow you to live comfortably, mentally and emotionally. Money decisions should check the boxes you care about, not the ones society assumes everyone should care about.

His primary financial goal is independence. Not early retirement in a flashy sense, not maximum returns, and not a lifestyle filled with luxury. Independence, for him, means waking up every day knowing that he and his family can make decisions on their own terms, without pressure, urgency, or financial fear.

To support this, he and his wife chose to maintain roughly the same lifestyle they had early in their careers even as their income grew. This wasn’t extreme frugality, nor was it austerity—it was consistency. The result was a steadily increasing savings rate. This approach works because both partners fully agree on it; there is no silent compromise or resentment underlying the choice.

One of his most notable decisions is owning a home outright. From a purely financial perspective, he acknowledges this may be inefficient—leveraging cheap debt could potentially generate higher returns elsewhere. But emotionally, owning his home gives him a sense of security and independence that outweighs any theoretical gain. For him, it is a good money decision even if it’s not a perfectly rational one.

Housel openly admits that good decisions are not always the most mathematically correct ones. At some point, people have to choose between being objectively “right” and being content. His guiding rule is simple: avoid interrupting compounding unnecessarily. Stability, patience, and staying invested matter more than clever moves.

Accordingly, his investment strategy is intentionally plain. Most of his investments are in low-cost index funds. His net worth is largely made up of three things: his house, a checking account, and Vanguard index funds. He prefers simplicity, not because complexity is wrong, but because it offers him no additional benefit.

Above all, every decision he makes is filtered through one question: will this help me sleep well at night? That, more than returns, benchmarks, or optimization, is his standard.

The chapter closes with a grounding reminder: no one is crazy. People make financial decisions based on their own experiences, fears, goals, and values. What looks irrational from the outside often makes perfect sense from the inside.

At the end of the day, it is always going to be a choice between being happy and being ‘right’. They are rarely on the same side.

With that closed, here’s some news. I have about 4 book reviews to catch up on from tomorrow, so you will see a lot of book reviews in the coming month or so. I plan to do them more often, but I am also on a mission to do longer projects like these, not necessarily a book, but a big idea, concept or historical event. Have a great year ahead…

HAPPY NEW YEAR!

RELATED POSTS

View all