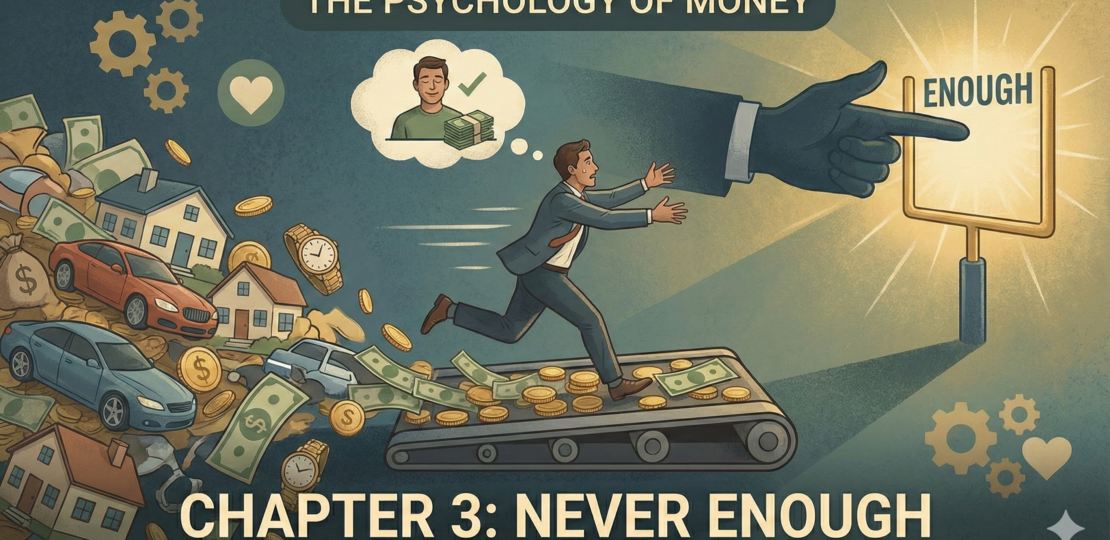

Welcome back. This is chapter 3 of the Psychology of Money. It addresses key stories of how greed can push even the richest people to lose almost everything.

Chapter 3: Never Enough

The stories themselves (not going to include here. Search up Rajat Gupta, Bernie Madoff for more information) aren’t surprising. They’ve happened often enough to feel almost predictable. People with more than enough continue to reach for more, even when the downside is obvious and unnecessary. What makes these cases worth studying is not the scale of money involved, but the pattern behind the decisions. As Housel puts it, “There is no reason to risk what you have and need for what you don’t have and don’t need.” Most financial disasters begin precisely where that line is crossed.

It’s tempting to label this behavior as greed alone, but that explanation is incomplete. Social comparison plays a quieter, more corrosive role. In a world saturated with visible success—especially through modern media—the goalpost rarely stays still. Someone else always appears richer, smarter, earlier, or more admired. External comparison feeds internal dissatisfaction, and restraint begins to feel like stagnation. The result isn’t reckless ambition, but misplaced risk-taking.

The idea of “enough” sits at the center of this chapter, and it is not a spreadsheet problem. Financial planning matters, but no amount of modeling can define enough for you. That line has to come from values, not optimization. Without it, progress turns into a treadmill, and success becomes fragile. Many of the most catastrophic failures weren’t caused by bad math or lack of intelligence, but by the refusal to stop.

What makes this lesson uncomfortable is how universal it is. This isn’t a flaw unique to billionaires or hedge fund managers. The scale changes, but the impulse doesn’t. Risking stability for status, or security for comparison, is a failure of restraint—and it is largely avoidable. The hardest part of managing money isn’t growing it. It’s knowing when growth no longer improves your life.

Note: I am reiterating myself if you missed my previous posts. I have specifically not included any direct example or quote from the book for two reasons.

A. I don’t want to be accused of plagiarism.

B. These posts are the public copy of my thoughts, not Morgan Housel’s thoughts.

RELATED POSTS

View all