Welcome back. This is chapter 5 of the Psychology of Money. It talks about how to stay wealth, safety margins, and the art of survival in finance. Let’s dive in.

Chapter 5: Getting Wealthy vs. Staying Wealthy

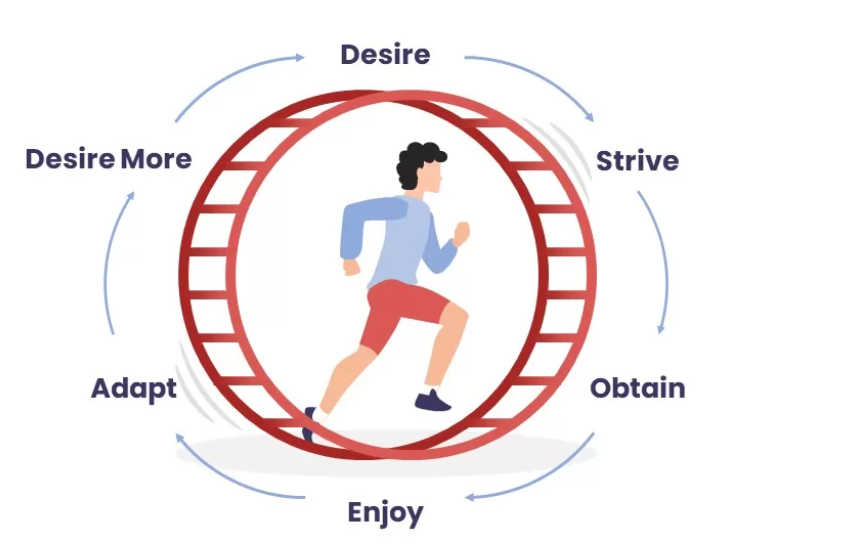

Getting wealthy often rewards optimism, boldness, and risk-taking. Staying wealthy rarely does. Many people who succeed early do so by pushing hard in environments that briefly tolerate error. The problem begins when those same behaviors are carried forward unchanged. Good investing is not necessarily about making brilliant decisions; it’s about consistently avoiding decisions that end the game. Survival, not brilliance, is what allows compounding to operate at all.

The story of Jesse Livermore captures this tension with tragic clarity. He was exceptionally skilled at making money, even thriving during moments when others collapsed. But success hardened into overconfidence, and restraint disappeared just when it mattered most. His failure wasn’t a lack of intelligence or courage—it was the inability to recognize when risk had stopped being necessary. Many fortunes are lost not because bets were wrong, but because they required everything to go exactly right.

This is why staying wealthy depends on habits that look unambitious from the outside: frugality, redundancy, and a willingness to accept outcomes that are merely “good enough.” Very few people can pursue extreme ambition without eventually colliding with constraints—family, health, timing, or sheer randomness. Recognizing this isn’t pessimism; it’s probabilistic honesty. Knowing when to step back is not a weakness. It’s a skill.

The most resilient approach to money pairs optimism with paranoia. Optimism about long-term progress, paired with constant awareness of what could derail it. Planning matters, but the most important plan is assuming the plan will fail at some point—and being built to withstand that failure. Margin of safety is not a drag on returns; it is what makes returns possible over time.

In the end, the goal is not maximizing returns at all costs. It’s becoming financially unbreakable. Survival keeps you in the game long enough for luck, skill, and compounding to matter. Without it, none of the rest counts.

Note: I am reiterating myself if you missed my previous posts. I have specifically not included any direct example or quote from the book for two reasons.

A. I don’t want to be accused of plagiarism.

B. These posts are the public copy of my thoughts, not Morgan Housel’s thoughts.

RELATED POSTS

View all