This is going to be a long one; I couldn’t find the right break to separate it. Bear with me. This is a story I wanted to talk about for a long time. It is probably one of the riskiest moves by an Indian prime minister that could have backfired so easily. The margins were slim, but it somehow worked.

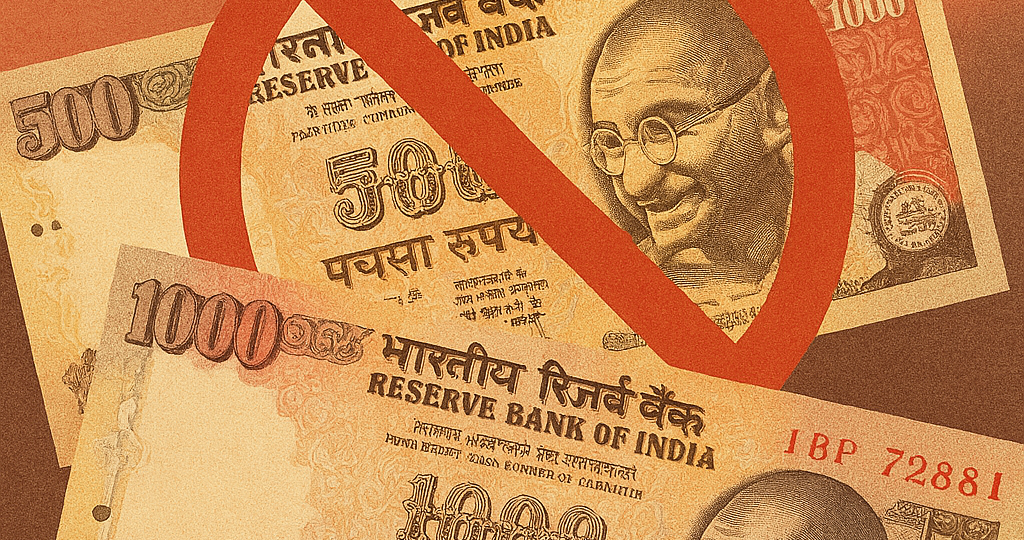

On the evening of November 8, 2016, Prime Minister Narendra Modi addressed the nation and dropped a financial bombshell: all ₹500 and ₹1,000 notes — which made up 86% of the cash in circulation — would cease to be legal tender, effective midnight. The goal? To wipe out black money, counterfeit currency, and terror financing, while pushing India toward a cashless digital economy. But almost overnight, a country heavily reliant on cash was forced into a game of economic musical chairs.

The move shocked everyone — citizens, businesses, even many in Modi’s own party. ATMs ran dry, banks were swarmed, and people stood in hours-long queues just to exchange or deposit their now-useless notes. Small vendors, daily wage workers, and rural populations — many of whom didn’t even have bank accounts — were hit hardest. Critics called it economic chaos disguised as reform. Yet, despite the widespread inconvenience, the public reaction was strangely resilient. There was frustration, yes — but also a kind of collective pride. Many Indians believed they were enduring pain for the greater good.

Economists were split. Some hailed it as bold and necessary, a long-overdue clean-up of India’s shadow economy. Others, like Nobel laureate Amartya Sen, sharply criticized it, calling it a “despotic action” that hurt the poor far more than the corrupt. The Reserve Bank of India (RBI) later reported that over 99% of the demonetized notes had returned to the banking system, raising questions about how much black money was actually eliminated.

But here’s where things get more complex. While demonetization may not have flushed out as much unaccounted wealth as expected, it radically accelerated digitization in India. Services like Paytm, BHIM, and PhonePe surged in adoption. More importantly, the Unified Payments Interface (UPI) — launched by the National Payments Corporation of India — became the beating heart of India’s digital economy. With its seamless peer-to-peer and peer-to-merchant transfers, UPI brought modern financial infrastructure to the fingertips of millions, from metro cities to remote rural villages.

Today, India leads the world in real-time digital payments. UPI handles billions of transactions each month, far outpacing giants like the US, China, and the UK. What started as a financial shock in 2016 ultimately laid the groundwork for a fintech revolution. In a twist of irony, a decision meant to erase black money may have instead etched India’s name at the forefront of global digital finance.

Demonetization remains a deeply debated event — but its role in pushing India to become a cash-light, digitally confident economy is undeniable. What could have been a massive policy blunder instead became an inflection point, one that helped build the rails of a new financial India.

RELATED POSTS

View all